The Caribbean appeals to many international travelers and global citizens worldwide due to it’s weather, relaxing environment, and diverse cultures. However, foreign investors are also drawn to the region through the benefits of offshore banking in Caribbean tax havens.

In certain jurisdictions, investors and multinational corporations aiming to optimize their taxes may face scrutiny or labeling as tax evaders. Tax havens in the Caribbean impose virtually no taxes on individuals or offshore corporations, and several of the Caribbean’s popular tax havens offer attractive incentives to foreign investors who open offshore bank accounts or establish offshore businesses.

What is a tax haven?

A tax haven refers to a jurisdiction or country that offers favorable tax benefits and financial incentives to individuals and businesses. Tax havens normally have low or no income tax, no estate or inheritance tax, minimal reporting requirements, and strict privacy laws attracting individuals and companies from other countries who want to minimize their tax liabilities.

Tax havens often provide offshore financial services, such as local and offshore banking, asset protection, and company formation, making them attractive for wealth management, international monetary or asset transfers, and tax planning purposes.

While legitimate reasons exist for utilizing pure tax havens, such as international business transactions, they have also been criticized for facilitating tax evasion, money laundering, and illicit financial activities. Investors should review their country’s tax regulations accusations of tax avoidance and other illegal activities. However, there are countries that don’t charge any tax on property or income tax.

So, let’s delve straight into the world of Caribbean taxes.

1. Cayman Islands

Beyond its natural beauty, this pure tax haven in the Caribbean attracts international businesses and investors with its robust financial sector, sophisticated infrastructure, and favorable tax policies.

The Cayman Islands offers a variety of benefits to pay taxes that make it an attractive destination for expats and businesses and those who want to decrease their tax liability:

- There is no income tax imposed on income generated in the islands or foreign income, so residents can enjoy tax-free earnings.

- There are no capital gains taxes, inheritance taxes, or wealth taxes in the Cayman Islands, meaning people can keep more of their income and wealth.

- For businesses, the absence of corporate income tax and capital gains tax makes the Cayman Islands an appealing place for establishing offshore companies and conducting international business activities.

- Through a strong legal and financial infrastructure, these benefits on taxes contribute to the Cayman Islands’ reputation as a prominent offshore financial center.

Obtaining residency in the Cayman Islands

The most common way to get Cayman Islands residency for expats is through the Person of Independent Means route. Although this permit is temporary, it extends for 25 years and allows the inclusion of a spouse and dependents. However, it does not allow expats to work on the island.

To qualify, applicants must demonstrate an annual income of approximately $150,000 from sources outside the Cayman Islands. They must also maintain a local bank account with around $500,000 and invest $1,200,000 in the country, with a minimum of $610,000 directed towards real estate, particularly for those wishing to reside in the Cayman Islands.

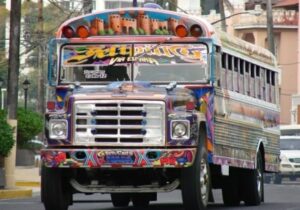

2. Panama

Living in Panama and offshore banking services in the country offer several benefits on taxes that make it an attractive destination for individuals and businesses:

- The country follows a territorial tax system, which means that only income earned within Panama by individuals living in the country or on and offshore Panamanian companies is subject to taxation.

- Foreign-source income is generally tax-exempt.

- Panama also offers various incentives for retirees, providing tax exemptions on various sources of income.

- There are no capital gains taxes, inheritance tax, or wealth tax in Panama, making it a favorable environment for financial growth and wealth preservation.

- Panama has double tax treaties with key nations, including France, the UK, Ireland, and Portugal.

Obtaining residency in Panama

Panama offers three main pathways for obtaining residency: through an investment-based residence visa, a retirement visa, or a visa for friendly nations. Rich investors may qualify for an expedited permanent residence process, which can take a month or less. After maintaining continuous residency in Panama for five years, expats can apply for citizenship through naturalization.

3. The Bahamas

The Bahamas offers attractive benefits on taxes for individuals and offshore corporations:

- There are no income taxes, capital gains taxes, or inheritance taxes in the country, meaning residents and those with offshore accounts enjoy tax-free earnings and investment returns.

- There are no taxes on wealth or dividends, creating a favorable financial environment for tax residents.

Obtaining residency in the Bahamas

The Bahamas offers two options for residence by investment programs. One option involves investing a minimum of $500,000 in business activity to get an annual resident permit. However, the more attractive option is the real estate program, which provides permanent residence and a potential path to citizenship.

To qualify, you must invest at least $500,000, with investments over $1.5 million receiving faster consideration. The real estate program can be particularly appealing to American individuals who want to live tax-free. It’s important to note that this requires ten years of legal residence to be eligible for naturalization as a Bahamian.

4. British Virgin Islands

With powdery white-sand beaches, secluded coves, and crystal-clear waters, the British Overseas Territory is a haven for water sports enthusiasts and beach lovers alike. Its laid-back atmosphere and unspoiled landscapes make it a true tropical paradise.

Benefits on taxes for those living in the British Virgin Islands include the following:

- There is no personal income or corporate tax, capital gains taxes, inheritance taxes, or wealth taxes.

- Residents can enjoy tax-free earnings, investment returns, and wealth accumulation.

- The country offers strict banking secrecy laws, attracting individuals seeking asset protection and wealth management opportunities.

Obtaining residency in the British Virgin Islands

The British Virgin Islands doesn’t have a formal residence by investment program, but they do offer annual residence permits for individuals wishing to stay on the islands and take advantage of the very low tax environment. The “Residence without Work” permit allows a one-year stay, with limitations on working except for managing personal assets.

The Self-Employed category permits individuals to operate their own businesses on the islands. Both programs have a straightforward approval process and offer a swift timeline.

5. Dominica

With a rich cultural heritage and warm hospitality, it invites expats to explore its natural wonders and immerse themselves in its vibrant local traditions.

Dominica’s tax benefits are as follows:

- Only income earned within Dominica is subject to taxation.

- Dominica taxes do not include capital gains tax, inheritance tax, or wealth tax.

- Dominica offers attractive tax incentives for individuals who successfully apply for its citizenship by investment program.

- There is zero tax on interest earned in offshore bank accounts, and information about account holders is not shared with foreign tax authorities.

Obtaining residency in Dominica

To be eligible for tax residence in Dominica, you have to fulfill certain criteria, such as living in Dominica for at least 183 days in a tax year, establishing a permanent home in the country, and demonstrating the intention to live there long-term. Dominica also offers Caribbean citizenship by investment, allowing investors to gain citizenship and access the country’s favorable tax policies by investment in the economy.

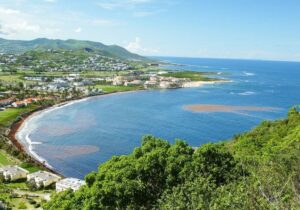

6. Saint Kitts and Nevis

From historical sites to outdoor adventures, these island paradises beckon visitors to relax, explore, and embrace their laid-back Caribbean charm.

Saint Kitts and Nevis offers some attractive benefits on taxes:

- Financial privacy by maintaining confidentiality regarding the owners and directors of offshore companies.

- Incorporating a company in Saint Kitts and Nevis requires only one director and one shareholder, allowing for a streamlined process.

- Saint Kitts and Nevis Trusts are not subjected to stamp duty on transactions.

- There are no local taxes on income earned outside of Saint Kitts and Nevis.

- Offshore companies and their owners are exempt from withholding taxes, capital gains taxes, estate taxes, corporate taxes, payroll taxes, and local taxes on income generated outside of Saint Kitts and Nevis.

Obtaining residency in Saint Kitts and Nevis

Becoming a tax resident in Saint Kitts and Nevis is similar to Dominica. You’ll have to spend a substantial amount of time in the country, typically at least 183 days per year. You’ll also have to show that you’ve got economic ties, such as owning St Kitts and Nevis real estate or having a local job or business.

The St Kitts and Nevis citizenship by investment program provides a straightforward route to Caribbean passport tax benefits, with investors able to obtain Caribbean citizenship through donating to the country’s national fund or purchasing real estate.

7. Anguilla

From water sports to exquisite cuisine, this idyllic place in the Caribbean is ideal for expats to unwind and indulge in pure tropical bliss, and investors need not worry about income or capital gains generated in the country or abroad.

Anguilla offers the following tax benefits:

- There are no personal income taxes, real estate taxes, capital gains taxes, or inheritance taxes.

- There are no wealth or property taxes.

Obtaining residency in Anguilla

Anguilla offers two residency by investment schemes, which provide potential workarounds for individuals with some level of wealth. The residency by investment option involves investing $750,000 in island real estate or making a one-time gift of $150,000 per application to Anguilla’s Capital Development Fund, supporting public sector initiatives.

Alternatively, the High-Value Resident Program has requirements such as paying $75,000 in annual income taxes to the Anguilla Treasury and owning a property worth over $400,000. However, this program may not provide the most favorable tax residency benefits.

8. Costa Rica

Costa Rica offers some enticing tax benefits for business owners:

- Costa Rican businesses have the flexibility to conduct business both domestically and internationally.

- Revenue generated by companies that operate solely outside the jurisdiction is not subject to local taxes.

- Costa Rica offers eight-year tax exemptions to many corporations, and for corporate entities that are subject to taxes, the rates are significantly lower, and they generally enjoy exemptions on interest, capital gains, and dividend income taxes.

- Costa Rica is popular for offshore bank accounts, low real estate taxes, corporate tax and generally low tax liability

- Offshore companies in Costa Rica don’t have to submit financial reports to the local tax authorities, and the owners’ identities are not required to be disclosed to the registrar of companies, ensuring privacy.

- The country places a strong emphasis on protecting the privacy of offshore banking, enabling unrestricted transfers of money or financial assets without limitations on amounts or the need to disclose the source of funds.

- Costa Rica has double tax treaties with key nations, including Germany, and Spain.

Obtaining residency in Costa Rica

Costa Rican tax residence can be obtained via the following routes:

- Residency through the Investor Visa ($150,000 bank deposit or real estate investment)

- Pensioner visa ($1,000 monthly income)

- Rentista Visa ($2,500 monthly income)

- Company formation

9. Belize

Belize has some great tax benefits on offer and is one of many fantastic tax free Caribbean islands:

- Opportunities for offshore banking and the convenient establishment of offshore companies, trusts, and foundations.

- Offshore businesses incorporated in Belize enjoy tax exemptions on foreign income.

- Belize-incorporated companies and trusts are not required to pay stamp duty.

- Offshore bank accounts in Belize are not taxed on earned interest and are not subject to repatriation or capital gains taxes.

- The country’s banking legislation ensures strict confidentiality for offshore banking.

- Belize has established double tax treaties with CARICOM nations, the UK, and Switzerland.

Obtaining residency in Belize

Although Belize does not have a citizenship by investment scheme, the immigration restrictions are generally flexible, and it is not difficult to become a resident. Although the country’s Department of Labor must first approve a work visa application, the fastest way to get one is to enter on a tourist visa.

You can apply to have it renewed every 30 days until you have had it for 50 weeks (you are not required to be in Belize during this time), and then apply for permanent residency. The entire procedure, including evaluation and acceptance, might take up to a year.

If you’re over 45, another and even simpler option is to apply for a retired residency visa. If your dependents are under the age of 23, they may also be included on this visa. Simply proving that the retiree makes at least $2,000 a month, which is more than enough to live comfortably in Belize, is all that is required. After five years as a permanent resident, you can apply for citizenship

10. Barbados

From its UNESCO World Heritage sites to its flavorful cuisine, this island gem offers a delightful blend of relaxation and exploration.

About Barbados’ tax benefits:

- Barbados is not considered a pure Caribbean tax haven.

- It is known for being a highly favorable tax environment for offshore corporations.

- Taxes on offshore company profits in Barbados typically range from 0 percent to 5.5 percent, with the tax rate decreasing as profits increase.

- Offshore companies are exempt from paying import duties on machinery and business equipment.

- It also offers the advantage of no withholding taxes or capital gains taxes.

- Barbados has established double taxation treaties with several countries, including Canada and the United States

Obtaining residency in Barbados

Similar to many other Caribbean countries, to become a tax resident, you need to do the following:

- Spend at least 183 days in Barbados.

- Have a permanent home and economic ties in the country.

The Caribbean has a plethora of options for expats seeking a profitable place to see their wealth grow without paying a huge amount of taxes. Whilst each country stipulates the requirements for becoming a tax resident, many countries have very similar rules.

Caribbean Tax Haven Comparison Table

Country | Personal Income Tax | Corporate Taxes | Wealth, Inheritance, Capital Gains Tax | Annual Property Tax |

Cayman Islands | No | No | No | No |

Panama | Foreign Income (0 to 25 percent) | Foreign Income 25 percent) | No | 0 to 1 percent |

Bahamas | No | No - Foreign income (15 percent) | No | 0.625 to 1 percent (0 for properties valued up to $300,000) |

British Virgin Islands | No | No | No | No |

Dominica | Foreign Income (0 to 35 percent) | Foreign income (25 percent) | No | No (1.25 percent municipal tax for properties in Roseau and Canefield) |

St Kitts and Nevis | No | Foreign income (33 percent) | No | 0 to 0.75 percent |

Anguilla | No | No | No | No |

Costa Rica | Foreign income (0 to 25 percent) | Foreign income (5 to 30 percent) | Capital gains | 0.25 percent |

Belize | Foreign income (25 percent) | Foreign income (25 percent) | No | 0.75 to 1.5 percent |

Barbados | 0 to 28.5 percent | 0 to 5.5 percent | No | 0 to 0.75 percent |

Why use Global Citizen Solutions?

Global Citizen Solutions is a multidisciplinary firm offering bespoke residence and citizenship solutions in Europe and the Caribbean. In a world where the economy and politics are unpredictable, having a second citizenship opens up opportunities and creates flexibility for you and your family.

So, why work with Global Citizen Solutions to obtain Caribbean citizenship?

- Global approach by local experts: We are corporate members of the Investment Migration Council, with local expertise in all five Caribbean CBI programs.

- 100 percent approval rate: We have never had a case rejected and will offer you an initial, free-of-charge, due diligence assessment before signing any contract.

- Independent service and full transparency: We will present to you all the investment options available, and all expenses will be discussed in advance, with no hidden fees.

- An all-encompassing solution: A multidisciplinary team of immigration lawyers, investment specialists, and tax experts will take into consideration all your and your family's mobility, tax, and lifestyle needs.

- Confidential service and secure data management: All private data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

Frequently Asked Questions about the Top Ten Offshore Caribbean Tax Havens

What Caribbean countries are tax havens?

Several Caribbean countries are known for their reputation as tax havens, including the Cayman Islands, Bahamas, British Virgin Islands, Dominica, Nevis, Anguilla, and Barbados. These jurisdictions offer favorable tax regimes and financial privacy for individuals and corporations seeking to optimize their tax obligations.

Which Caribbean island has the lowest taxes?

This varies depending on specific tax categories and structures. However, several islands, such as the Cayman Islands, Bahamas, and Barbados, are often considered to have favorable tax environments with relatively low tax rates for certain types of entities.

Are the Bahamas a tax haven?

Yes, the Bahamas is often considered a Caribbean tax haven due to its favorable tax regime, which includes no income taxes, no capital gains taxes, and no inheritance tax. It offers financial privacy and a range of offshore services, making it attractive to individuals and businesses seeking tax optimization and asset protection.

Is Turks and Caicos a tax haven?

Turks and Caicos has no income tax, no capital gains taxes, and no inheritance tax. It also offers opportunities for individuals and businesses to optimize their tax obligations and enjoy financial privacy. It’s therefore considered a Caribbean tax haven.

Is St Maarten a tax haven?

St Maarten is not typically considered a Caribbean tax haven. It imposes taxes on personal income, corporate profits, and capital gains. However, it does offer some tax incentives for businesses, such as exemptions for certain industries, which can make it attractive for investment purposes.

Which Caribbean country has no inheritance tax?

Caribbean nations that do not require tax residents to pay taxes on inheritance include:

- Anguilla

- Antigua and Barbuda

- Turks and Caicos Islands

- Dominica

- Grenada

- Panama

- St Lucia

Are tax havens illegal?

Tax havens themselves are not inherently illegal. They are jurisdictions that impose low taxes or zero taxes. However, tax havens can sometimes be associated with illicit activities such as tax evasion, money laundering, and other financial crimes. It is up to the individual to comply with their country’s tax regulations and avoid allegations of tax abuse by providing accurate financial reports and tax returns.

Can US citizens benefit from Caribbean tax havens?

US citizens can benefit from tax havens in the Caribbean by establishing tax residency in a pure tax haven and utilizing tax reduction measures such as the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC).

Which Caribbean island is tax free?

The best tax-free Caribbean islands you can easily relocate to are:

- Cayman Islands

- Panama

- The Bahamas

- British Virgin Islands

- Dominica

- St. Kitts and Nevis

- Anguilla

- Costa Rica

- Belize