The Antigua and Barbuda tax framework favors US expats, enabling them to optimize their taxes and even alleviate some of their tax burdens.

Propelled by the Antigua and Barbuda Citizenship by Investment Program, it has never been easier for American foreign investors to invest in Antigua and Barbuda, obtain a travel-friendly passport, and legally reside on the island to acquire Antigua tax residency.

In this guide, we’ll unpack everything you need to know about taxes in Antigua and Barbuda for Americans, guiding you through all the taxes in Antigua imposed by the island’s revenue department, as well as recent Antigua tax reforms.

At the end of this piece, you’ll have a nuanced understanding of how Antigua and Barbuda’s tax regime can benefit you.

Key Antigua and Barbuda Tax Statistics

- Income tax rate: Antigua tax residents maintaining permanent residence in the country do not pay personal income tax. Companies registered in Antigua and Barbuda must pay a flat corporate tax rate of 25 percent.

- Primary tax forms: The Antigua and Barbuda Inland Revenue Department no longer issues printed payment or tax declaration forms.

- Tax year: The tax year in Antigua and Barbuda is based on a company’s fiscal year-end

- Tax deadline: Antigua and Barbuda’s tax deadline for a self-employed Antigua and Barbuda tax resident international business corporation operating in the country is 31 March.

- Currency: Antigua and Barbuda taxes are based on the Eastern Caribbean Dollar (XCD), the country’s official currency, which maintains a fixed exchange rate of 2.70 XCP to 1 USD.

- Tax treaty: Antigua and Barbuda and the United States do not have a double tax agreement.

- Totalization agreement: Antigua and Barbuda and the United States do not share a totalization agreement to prevent American expats from double taxation on Social Security income.

Antigua Personal Income Tax

In 2016, the government of Antigua and Barbuda introduced a sweeping tax reform, thereby abolishing the need for personal income tax.

In essence, this means that Antigua and Barbuda has no personal income tax, so no taxes whatsoever are deducted from the personal income of US citizens with tax residence in the country.

The authorities made this move to attract foreign interest to its shores, as well as position themselves competitively among their Caribbean neighbors.

Non-residents, however, pay a withholding tax of 25 percent on dividends, interest, and royalties gained in the nation.

Self-employment tax in Antigua and Barbuda

If you earn self-employment income in Antigua and Barbuda, there is a variable tax rate of 0, 8, or 25 percent. An Antigua and Barbuda tax calculator can assist with determining the correct tax rate. Self-employed Americans must register with the Antigua and Barbuda Inland Revenue Department and obtain an Antigua Tax Identification Number.

Taxes in Antigua and Barbuda for US Expats

By becoming an Antigua and Barbuda citizen via the Antigua and Barbuda Citizenship by Investment Program, Americans can avoid double taxation due to Antigua and Barbuda’s zero percent personal income tax rate.

The US Foreign tax credit of $120,000 for 2024 allows Americans living in Antigua and Barbuda to significantly reduce their tax obligations. Foreign tax credits are also available to other foreign nationals in Antigua and Barbuda who have paid or are liable to pay British commonwealth income tax.

Antigua and Barbud’s government actively encourages company owners to relocate their headquarters to the country, thanks to friendly tax incentives for resident and non-resident companies. Moreover, individuals are exempt from income tax on worldwide income or assets held in foreign financial institutions by holding Antiguan citizenship— without needing to register their tax residence in the country. Only income derived from inside the country is subject to taxation.

Antigua and Barbuda offers the following tax benefits:

No personal income tax, include tax on worldwide income

Attractive tax breaks on qualifying companies’ profits for up to 20 years

Certain waivers and exemptions on customs duties for qualifying companies

No capital gains tax, inheritance tax, or wealth tax

About Antigua and Barbuda

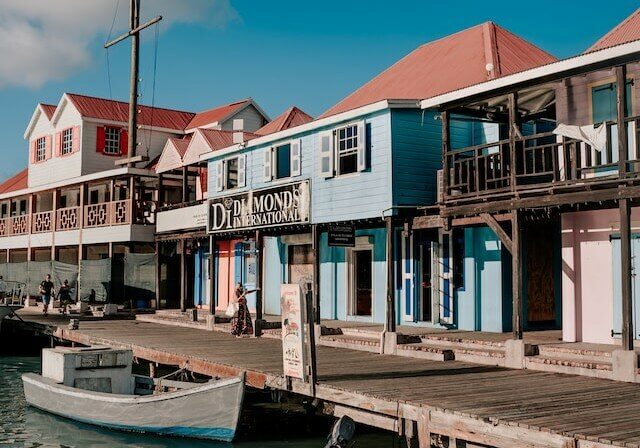

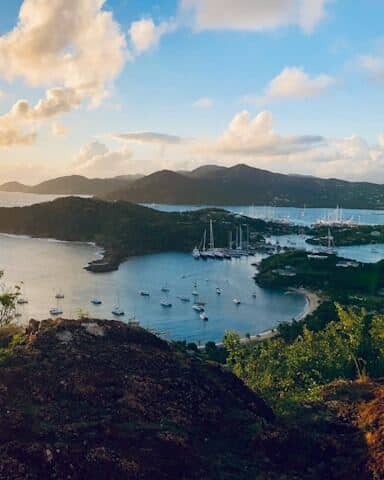

Located in the Eastern Caribbean, Antigua and Barbuda is a tropical island nation filled with secluded bays, sandy beaches, coral reefs, and volcanic rocks dramatically rising up to Mount Obama. One of the wealthiest nations in the Caribbean, Antigua and Barbuda is blessed with nature and a warm, balmy climate, and it’s only natural then that the island attracts tourists year-round.

However, the government also offers foreign nationals the chance of a lifetime — to earn Antigua citizenship — in exchange for making a qualifying investment in the nation. Called the Antigua and Barbuda Citizenship By Investment Program, the initiative is particularly popular among entrepreneurs, digital nomads, investors, expat families, and business-minded individuals looking to enhance their personal and financial freedoms.

Antigua and Barbuda citizenship

Investors can acquire Antigua citizenship by either investing in real estate or business. Alternatively, foreign nationals can also make a non-refundable donation of $100,000 to the National Development Fund or a $150,000 donation to the University of the West Indies Fund.

Applicants to the economic citizenship program must go through a strict due diligence check carried out by the Barbuda Investment Authority in order to acquire an Antigua and Barbuda passport. Investing in Antigua and Barbuda rewards expats with a myriad of opportunities, including visa free travel to over 150 destinations worldwide, including the United Kingdom, Europe’s Schengen Area, Hong Kong, and more.

Tax advantages in Antigua and Barbuda

Citizenship in Antigua and Barbuda comes with the right to become a tax resident of Antigua. One may wonder, Why pursue Antigua tax residency as an American? In short, the Antigua and Barbuda tax regime is favorable and considered moderate, enabling individuals to benefit from no capital gains taxes or estate taxes and no personal income taxes. The currency is the Eastern Caribbean Dollar (EC$), which is pegged to the US$ at 2.70.

While Antigua and Barbuda is by no means considered a ‘tax haven’, the nation does have a solid taxation structure that an investor could find appealing.

Antigua tax treaties and agreements

- Barbados

- Belize

- Dominica

- Jamaica

- Grenada

- Guyana

- Saint Kitts and Nevis

- Saint Lucia

- Saint Vincent and the Grenadines

- Sweden

- Switzerland

- Trinidad and Tobago

The nation also has Tax Information Exchange Agreements with countries including Aruba, Australia, Belgium, Denmark, Finland, France, Germany, Iceland, Ireland, Liechtenstein, the Netherlands, Netherlands Antilles, Norway, Sweden, the United Kingdom, and the United States.

In addition to this, Antigua and Barbuda has signed the Organization of Economic Cooperation and Development (OECD) Convention on Mutual Assistance in Tax Matters, implementing measures to facilitate the automatic exchange of financial account information under the OECD’s Common Reporting Standard (CRS).

Antigua Corporate Tax

- It is incorporated or registered as an external company in Antigua and Barbuda

- It is centrally managed and controlled in Antigua and Barbuda

- It operates in Antigua and Barbuda

- It receives income from Antigua and Barbuda

- Owns assets in Antigua and Barbuda that are used to generate income for the company

In this case, a resident company is taxed on worldwide income. Meanwhile, a non-resident company is taxed only on income derived or sourced from Antigua and Barbuda. This tax rate is applied on a sliding scale with rates ranging from zero to 25 percent of gross income and is due quarterly.

Regarding foreign tax relief, foreign tax credits are not normally given unless the taxes have been paid in a British Commonwealth country that grants similar relief for Antigua and Barbuda taxes or where there’s a tax treaty providing merit for such a credit.

Antigua tax benefits for International Business Companies

Antigua and Barbuda taxes and corporate laws offer several benefits for International Business Companies (IBC), including:

- No requirement to pay taxes of any kind or submit a tax return in Antigua and Barbuda

- No public records of the identities of shareholders of beneficiaries

- Fast company incorporation, usually within one business day

- Permission for 100 percent of company shares to be foreign owned

- No minimum capital requirement for incorporation and operation

- The option for a sole shareholder to be the sole director of the IBC

Social Security contributions in Antigua and Barbuda

Public and private sector companies and their employees must make mandatory social security contributions on insurable earnings for social welfare benefits. The social security tax rate is 14 percent for the private sector and 13 percent for the public sector.

Employers in the private sector pay a tax rate of eight percent, and employees pay six percent. Public sector companies also pay eight percent, whereas employees pay five percent.

Other Antigua Taxes to Consider

Property taxes: Antigua and Barbuda property tax depends on the market value of the property and ranges from 0.2 percent to 0.5 percent. Undeveloped land owned by a non-resident is subject to an undeveloped land tax, which is dependent on the value of the land, ranging from 10 percent to 20 percent, depending on the length of time the property has been owned.

Transfer tax: Non-residents must obtain an Alien Landholding License to legally conduct Antigua real estate transactions, which is 2.5 percent for the buyer, based on the property’s market value.

Stamp duty: Stamp duty tax on the sale of Antigua and Barbuda property is 7.5 percent for the seller and 2.5 percent for the buyer, based on the property’s purchasing value.

Sales tax: Similar to Value-Added Tax, ABST – or Antigua and Barbuda sales tax – is generally fixed at 17 percent as of 1 January 2024. However, hotels and holiday accommodations are lower at 10.5 percent and 12.5 percent, respectively.

How to Minimize Your Tax Liability as an American

Few of us in the world want to pay more taxes. Understanding tax credits and deductions as an American can significantly minimize tax liability— if structured correctly. One of the most efficient ways to ease your tax liability is to reduce the amount of your gross income subject to taxes, which is possible through submitting Form 1116 for the foreign tax credit along with IRS Form 1040 for a US tax return.

Other ways include increasing retirement investments to IRAs AND 401ks as well as Social Security contributions. Selling an investment that has lost value or donating to a charity like Antigua and Barbuda’s National Development Fund can potentially reduce your annual tax bills (if you itemize your deductions).

As you can see, Antigua and Barbuda residents benefit from a favorable tax environment of no capital gains tax, no estate taxes, and no personal income tax rates. Additionally, as tax residents, both individuals and companies can enjoy fantastic benefits on this beautiful island that many consider a tax haven.

Tax Deductions Available to US Expats in Antigua and Barbuda

Despite the United States citizenship-based taxation, specific tax deductions are available to Americans living in Antigua and Barbuda.

Foreign Tax Credit: The US Foreign Tax Credit (FTC) through FORM 1116 allows Americans living abroad to deduct taxes paid to a foreign tax jurisdiction.

Foreign Earned Income Exclusion: The Foreign Earned Income Exclusion (FEIE) through Form 2555 allows US citizens to foreign earnings from US taxable income. The 2024 exclusion threshold is $120,000, meaning if you earned that Amount in Antigua or any other country, you could eliminate that income from your US tax bill entirely.

Foreign Housing Exclusion: Americans can deduct specific housing-related expenses from US tax obligations by claiming the Foreign Housing Exclusion. American expats are eligible to claim this exclusion only if they also claim the Foreign Earned Income Exclusion by submitting Form 2555.

Why use Global Citizen Solutions?

Global Citizen Solutions is a multidisciplinary firm offering bespoke residence and citizenship solutions in Europe and the Caribbean. In a world where the economy and politics are unpredictable, having a second citizenship opens up opportunities and creates flexibility for you and your family.

- Authorized International Marketing Agent. Global Citizen Solutions have official certification by the Government of Antigua and Barbuda to promote and market their Citizenship by Investment program. You can find a copy of our certificate by clicking the image on the right

- Global approach by local experts. We are corporate members of the Investment Migration Council, with local expertise in all five Caribbean CBI programs.

- 100 percent approval rate. We have never had a case rejected and will offer you an initial, free-of-charge, due diligence assessment before signing any contract.

- Independent service and full transparency. We will present to you all the investment options available, and all expenses will be discussed in advance, with no hidden fees.

- An all-encompassing solution. A multidisciplinary team of immigration lawyers, investment specialists, and tax experts will take into consideration all your and your family's mobility, tax, and lifestyle needs.

- Confidential service and secure data management. All private data is stored within a GDPR-compliant database on a secure SSL-encrypted server.

Frequently Asked Questions About Antigua and Barbuda Tax

Is Antigua tax free?

Antigua and Barbuda is not a tax-free country. However, there are various Antigua and Barbuda tax exemptions and incentives. Residents and citizens of Antigua and Barbuda benefit from no capital gains, wealth, or inheritance taxes, as well as no personal income taxes.

Does Antigua tax worldwide income?

The advantage of tax residency in Antigua and Barbuda is that there is no income tax on worldwide earnings or assets and tax residents do not need to declare it on their Antigua tax returns.

What is the VAT in Antigua?

Standard VAT (Value Added Tax) in Antigua and Barbuda imposed by the Inland Revenue Department increased to 17 percent from 15 percent on 1 January 2024.

What is ABST tax?

ABST stands for Antigua and Barbuda sales tax. This is a value-added type of sales tax that is levied on local consumption and paid by the consumer.

What is Antigua property tax?

Property tax in Antigua is assessed based on the property’s market value, which ranges from 0.1 percent to 0.5 percent. The tax rates depend on the property’s classification, whether residential or commercial. In general, residential buildings are taxed at 0.3 percent.

Is Antigua and Barbuda a tax haven?

Antigua and Barbuda is not a tax haven, but it has a progressive and moderate tax regime that offers many advantages for expats. For example, tax residents don’t pay inheritance tax, income tax, wealth tax, or tax on capital gains.

Do you have to pay tax in Antigua?

An individual or legal entity must pay taxes in Antigua to the Inland Revenue Department. The Antigua and Barbuda tax rate you pay for some taxes can be influenced by whether you are a tax resident or not. For example, residents do not pay personal income tax, while non-residents are liable to pay an Antigua and Barbuda withholding tax rate of 25 percent.

How do I become a tax resident in Antigua?

To acquire Antigua tax residency, you have to maintain a residential address in Antigua and Barbuda, spend a minimum of 30 days each year in the country, have an annual income above $100,000, and pay a flat tax fee of $20,000 per annum. Tax residents pay no income tax, capital gains tax, inheritance tax, and wealth tax on worldwide income or assets. Income generated in Antigua and Barbuda is taxed up to 25 percent.

Does Antigua and Barbuda offer specific tax benefits for certain sectors or industries?

When it comes to sales tax, which is similar to value-added tax (VAT), hotels enjoy a lowered rate of 10.5 percent, while holiday accommodations enjoy a rate of 12.5 percent. The standard sales tax rate imposed by the Antigua and Barbuda Inland Revenue Department is 17 percent.

Does the US have a tax treaty with Antigua?

The US does not have a tax treaty with Antigua and Barbuda.

How do Controlled Foreign Corporation regulations function in Antigua and Barbuda?

Controlled Foreign Company (CFC) rules are designed to prevent tax evasion by ensuring residents cannon artificially shift income to offshore entities in tax haven or low-tax jurisdictions. However, Antigua and Barbuda has no specific Controlled Foreign Corporation regulations.