When you start seeing the end of the line to your professional working career, you’re probably thinking of where to retire. There is some comfort in retiring in the town you grew up in or in a bustling metropolis, but where is the fun in that? Did you know that some of the best European places to retire are within your grasp and easier than you think.

If the idea of kicking it back on beautiful beaches with year-round sunshine and feasting on a healthy Mediterranean diet appeals to you, there are plenty of ideas for your golden years. In this article, we’ll explain the financial requirements, establishing residency and how you can make the best European places to retire a reality.

Why Retire Abroad

Money matters, too. Some European countries have a lower cost of living than more developed nations, meaning your savings can go further and you can have a better life. Plus, there are tax benefits for people living abroad, which can save you a lot over time.

Healthcare is another big reason. Many countries with lots of people from other countries have great healthcare that’s much cheaper than in the West. Good healthcare makes retirement more comfortable.

But think carefully before you move. Some of the best retirement spots might not be right for you. It’s great to live near a ski resort, but if you’re not into sports, the pretty views won’t make up for it.

10 Best Places to Retire in Europe

1. Portugal

There are two ways non-EU citizens can retire in Portugal, either through the retirement visa, or the Golden Visa. Both options provide individuals with residency rights in Portugal and can eventually lead to Portuguese citizenship. The main difference between the two is that Portugal’s Golden Visa has the added benefit of giving you a return on your investment, since it requires you to place one.

The Portuguese retirement visa, D7, grants residency rights in Portugal to non-EU, non-EEA, and non-Swiss nationals who have reasonable passive income to sustain their stay. It launched in 2007 as an affordable Portugal immigration visa, and is geared toward pensioners, retirees, self-employed individuals, digital entrepreneurs, and other expats who have a recognized stable income.

Portugal’s Golden Visa is a residency-by-investment program that grants residency rights in Portugal to qualifying individuals and their immediate family members, in exchange for a substantial financial investment.

It is perfectly suited for anyone planning for their retirement, as they can get a return on their investment and fully reap the rewards of their lifelong labor. Of course, as an investor immigration program, the scheme has more qualification requirements than the D7 visa.

Different cities across Portugal cater to different lifestyles. You could live in a city center full of excellent restaurants and vibrant nightlife, like Porto and Lisbon. There are other suitable places to retire in Portugal as well, such as Tavira, Cascais, and Estoril.

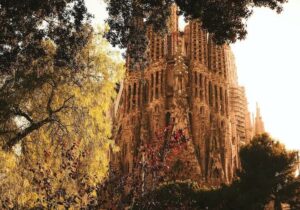

2. Spain

Its warm climate, political stability, and high standard of living have made it one of the top 10 countries to retire abroad.

Being the biggest country in Southern Europe, it has a thriving and expansive property market that will certainly meet your needs. There are two primary ways non-EU citizens can retire in Spain, either by acquiring the Spain Retirement Visa, or the Spanish Golden Visa.

Both options provide you with the same rights for residency in Spain, and can lead you toward permanent residency after five years, and even citizenship after ten years of living in the nation.

The main difference between the two is that the Spain Golden Visa requires a financial investment in the country in exchange for your residency permit, while the retirement visa only requires you to show proof of sufficient funds to maintain your stay in Spain, specifically at least €30,000 in your bank account.

Golden Visa Spain is an incredible route for retirement, especially for those who are considering buying property in Spain. It grants the primary visa applicants residency permits in the nation, and extends those rights to their entire immediate family members, thereby permitting them all the right to live, work and study there as well.

Madrid and Barcelona are some of the larger cities that offer a dynamic and diverse lifestyle, cultural activities all year long, and high quality restaurants and cafes. They are also the easiest to navigate around, as they have excellent infrastructure and reliable transportation systems.

3. Malta

Any non-EU, non-EEA or non-Swiss national planning on retiring in Malta can do so under the government’s residency and citizenship programs to gain the most out of their retirement. In fact, Malta’s residency and citizenship schemes act as a path for you into the EU where there is the lowest enforced tax, and provide you with the chance at family reunification, as they both enable you to extend those residency rights to your entire immediate family.

Malta has a citizenship by naturalization scheme that is a promising prospect for anyone with enough financial means who is planning for retirement in Europe.

Commonly inaccurately referred to as the Malta citizenship by investment program, the Maltese Citizenship Act Granting of Citizenship for Exceptional Services Regulations (CES) provides qualifying individuals with permanent residency rights, as well as a Malta passport in as little as 12 to 36 months, depending on their investment. With the nation being a member state of the European Union, this scheme is advantageous over its counterparts.

Residency by investment in Malta is another great path to take if you’re considering buying property in Malta. It is actually an affordable retirement option, as a minimum investment of €110,000 can qualify you for permanent residence rights in as little as 12 months, and provide you with freedom of movement across the EU, among a magnitude of tax benefits.

4. Greece

The high English-speaking community, fair weather, and low cost of living in Greece are some of the primary reasons why many retirees choose it. There are two possible paths for individuals to plan for their retirement in Greece, and that’s either by applying to the Greek Golden Visa, or the Greek retirement visa – otherwise referred to as the Financially Independent Person (FIP) visa.

The Greek Golden Visa provides individuals with renewable residency permits in exchange for an investment in the nation’s economy, whereas the retirement visa asks that applicants show proof of their sufficient financial means to cover their intended stay in Greece.

Each route caters to different financial objectives. However, both grant you the same right to living in Greece. Golden Visa Greece is suitable for any non-EU, non-EEA, or non-Swiss citizen interested in buying Greek property and retiring abroad.

It’s a residency by investment program that grants qualifying individuals renewable residence permits in exchange for an investment in the Greek economy – usually in real estate. The current minimum threshold for a real estate property investment is €250,000, which grants you a five year renewable permit that can lead to citizenship in seven years.

5. Turkey

It is a major transactional country with a thriving economy and an expansive real estate market, and is known for its rich history, vibrant culture, natural beauty, Mediterranean coastline, affordable prices, and overall great food.

There are two ways to retire in Turkey; either by applying for a residence visa and obtaining a short-term residence permit which can be renewed every two years, or by investing in the nation’s citizenship by investment program and directly obtaining Turkish citizenship.

The latter choice is undoubtedly the most rewarding out of the two, albeit, it requires a higher financial investment.

Turkey’s investment citizenship program grants qualifying individuals and their immediate family members lifelong Turkish citizenship in as little as four months, in exchange for a financial contribution in the nation’s economy.

It is perfectly suited for anyone considering buying property in Turkey worth at least $400,000, as that is the minimum qualifying investment threshold under the route of real estate.

6. France

French culture, with its deep appreciation for the finer things in life, influences its world-renowned cuisine, fashion, and philosophy. Landmarks like the Eiffel Tower and the Louvre embody France’s rich historical tapestry, while its commitment to liberty, fraternity, and equality continues to inspire.

France is a country that celebrates its past while always looking stylishly towards the future. France’s healthcare system is recognized as one of the best in the world, providing comprehensive coverage through a combination of public and private contributions.

It ensures access to high-quality medical services for all residents, with costs largely subsidized by the government. The system prides itself on excellent patient care, though it can come with waiting times for non-emergency procedures.

For retirees, France offers a myriad of charming options. The Dordogne region is known for its idyllic villages and stunning landscapes. Provence captivates with its sun-drenched vineyards and artistic legacy, while Brittany offers rugged coastlines and a cooler climate.

The French Riviera, with cities like Nice, appeals for its Mediterranean climate and vibrant cultural scene.

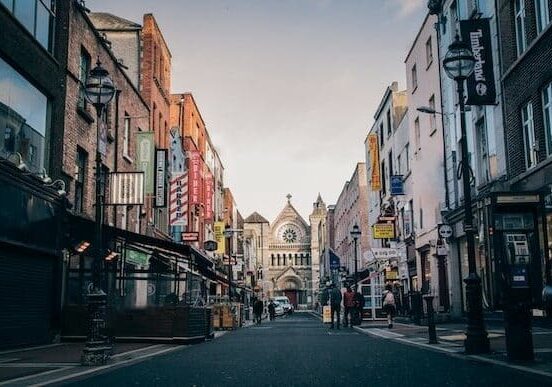

7. Ireland

Its rugged coastlines, verdant hills, and mystical peat bogs are steeped in centuries-old legends and folklore, while its towns pulse with vibrant cultural life and the warmth of Irish hospitality.

Ireland’s rich history is etched into the ruins of castles and monastic sites that dot the countryside, telling tales of a turbulent past. Meanwhile, cities like Dublin and Cork offer a dynamic mix of traditional pubs, cutting-edge cuisine, and literary heritage. Ireland’s enduring charm lies in its ability to meld the old with the new, inviting visitors to explore its many wonders.

Ireland’s healthcare system operates on a mixed public-private basis. Public healthcare is available to all residents, funded through general taxation, but can often involve long waiting times. Many choose private insurance to access faster and more flexible healthcare services. Despite the challenges, the system provides comprehensive care across the board.

Ireland offers retirees the choice between vibrant city life and tranquil countryside settings. Counties like Kerry and Galway are famous for their breathtaking landscapes and welcoming communities. The coastal towns of Cork offer mild climates and scenic beauty, while Dublin provides access to cultural and urban amenities without sacrificing the green Irish countryside.

Frequently Asked Questions about the Best European Places to Retire

Which is the best European country to retire to?

The best retirement destination in Europe would be the one that offers you the most benefits as a resident and retiree. Here are 10 top choices for retirement in Europe:

- Tavira, Portugal

- Annecy, France

- Ljubljana, Slovenia

- Cascais, Portugal

- Paphos, Cyprus

- Kotor Bay, Montenegro

- County Clare, Ireland

- Paris, France

Where is the cheapest place to retire in Europe?

Some of the cheapest places to retire in Europe include Malta, Spain, Portugal, Turkey and Greece.

What is the cheapest and safest country to retire?

Portugal is one of the cheapest and safest countries to retire. It is actually ranked as the 6th safest country in the world according to World Population Review and the Global Peace Index. Other countries include Malta, and Spain.

How to retire in Europe as an American?

Americans planning on retiring in Europe can either do so by applying for a retirement visa, or by applying to the respective country’s Golden Visa program. The latter is more suitable if you’re considering placing a real estate investment in Europe.

Which European country is easiest to retire in?

Greece and Malta are some of the best and easiest places to retire in Europe, as they have large English-speaking communities. Other European destinations that are also suitable for retirement are Portugal, Spain, and Turkey.