Homeownership provides stability and a lasting investment. Buying property in Brazil offers the dual benefits of a long-term asset and a pathway to obtaining permanent residency through property investment. This article will provide insights into the Brazilian property market, how to buy property in Brazil, and the requirements to obtain permanent residency through purchasing property.

Why buy property in Brazil?

Several reasons highlight why an increasing number of foreigners buy property in Brazil and embrace a new way of life in South America.

Six reasons to buy real estate in Brazil

- Foreigners buying property in Brazil valued at least BRL 700,000 (about $140,000) in the north/northeast regions or BRL 1,000,000 (about $200,000) anywhere else in Brazil qualify for the Brazil Investor Visa, granting permanent residence to real estate investors.

- Brazil has comparatively lower average house prices than the United States and other Western countries, with foreigners able to buy large rural properties or beach-front condos for affordable prices.

- Brazil is a popular and growing tourist destination, making buying real estate in cities such as Rio de Janeiro, Florianopolis, and São Paulo an appealing idea for foreign buyers looking to capitalize on the tourism industry’s growth and secure properties in highly sought-after locations.

- Compared to the United States and other Western countries, the cost of living in Brazil is significantly more affordable.

- Brazil comprises half of South America and stretches over 2,700 miles in longitude, resulting in a diverse range of climates. The country offers various climatic conditions, from year-round tropical weather in the north to warm summers and cool winters in the south.

- Besides limitations on specific properties, foreigners can buy all types of Brazilian properties, from residential homes and rural land to commercial office buildings and resorts.

Overview of the Brazil Real Estate Market

Statista’s analysis reveals that the Brazilian real estate market registered a growth of nearly ten percent from 2017 to 2023 despite the considerable economic challenges posed by the Covid-19 pandemic. The analysis also forecasts continued growth, projecting a seven percent increase between 2023 and 2028.

Popular cities such as Rio de Janeiro and São Paulo propel the Brazilian property market forward, driving investment and development in both residential and commercial real estate sectors from foreigners and Brazilian citizens. Other cities, including Curitiba and Florianopolis, have become increasingly popular among Americans and other foreigners buying property in Brazil.

Typical Features of Brazilian Homes

It’s common to see gable roofing with walls made of clay or adobe. A prevalent feature in many Brazilian backyards is a barbecue area (área de churrasco), typically characterized by an extended roof providing shelter over a chimney and a built-in barbecue pit integrated into the property. It’s also not uncommon to find barbecues installed in apartment balconies in urban areas, with chimney ducts extending upwards along the length of the building.

Brazil’s colonial legacy has left behind many cities with historic centers, such as Pelourinho in Salvador, Bahia, and Paraty in Rio de Janeiro state, featuring centuries-old homes, many of which have been carefully preserved. However, these properties are often in high demand and come with a premium due to their historical value and architectural allure.

Can foreigners buy real estate in Brazil?

Americans and most non-Brazilians are free to buy a wide array of property in Brazil. The only restrictions or legal requirements a foreigner buying real estate in Brazil may encounter is maintaining the property’s integrity or intended use. For example, a rural property owner may have to comply with specific land use regulations and environmental conservation laws to ensure the preservation of natural resources and ecosystems.

The Brazilian government also prohibits foreign ownership of land near national borders or coastal areas.

The initial stage of the buying process includes obtaining a CPF number (Cadastro de Pessoas Físicas), an 11-digit national person registration number used for various purposes, including buying property.

Step-by-Step Guide to Buying Property in Brazil as a Foreigner

There are several reasons why Brazil is one of the best countries to buy real estate. Those embarking on a Brazilian property search and real estate investments in the country can start the process by following these steps.

- Search for a property: Research Brazil’s property market by browsing popular websites such as:

- OLX: An online marketplace similar to Craigslist in the US, featuring thousands of Brazilian properties for sale nationwide.

- QuintoAndar: An end-to-end platform for real estate investments connecting estate agents, sellers, and buyers.

- Hire a real estate agent: Local real estate agents can assist with a house search. Furthermore, the services of an investment migration consultant are beneficial for international buyers as they can direct investors to the right real estate agent to facilitate property purchases that meet the criteria for the citizenship by investment program.

- Obtain a Brazilian social security number: Apply for a CPF number at a Federal Police office in Brazil or a Brazilian Consulate in your home country.

- Check the property’s ownership and history: After identifying a property of interest, have a local lawyer evaluate the property records in the Public Deed to confirm property ownership and if the property has been involved in any legal issues, such as unpaid taxes and legal disputes.

- Sign a purchase agreement: After examining the title deed, negotiate the purchase price and terms with guidance from the lawyer and have a purchase and sale agreement drafted. The purchase and sale agreement should contain legal considerations, such as the timeline for the transaction to be completed.

- Make the down payment: Complete the formalities by signing the purchase and sale agreement. If you’re outside Brazil, you will need a Power of Attorney (POA) valid in Brazil for a representative to complete the purchase on your behalf, including paying a down payment of 5 to 15 percent of the property value.

- Submit certificates to the registry office: Brazilian laws require property transactions to be completed before a notary public. The real estate transaction and other legal considerations, including clearance certificates, should be examined by your lawyer and sent to the notary. Pay the required registration fees to the registration office to prepare for the property deed transfer.

- Pay transfer tax: In Brazil, a transfer tax is known as ITBI, a municipal real estate transfer tax charged on the transfer of a title deed. While most countries impose a federal transfer tax, the tax rate in Brazil varies at around three to five percent of the property value.

- Review the Public Deed of Sale: The property transaction with the Minuta da Escritura (Deed of Sale) will be available for your lawyer to review to confirm all details of the sale are correct and there are no negative legal encumbrances (certidões negativas) attached to the property.

- Close the sale: The sale will usually be completed at the registration office, which requires presenting all the necessary documents and proof that the taxes and fees involved have been paid.

Documents required to buy property in Brazil

While specific documents may vary depending on the type of property and its purpose, the necessary documents required from a foreign buyer include:

- Valid passport

- Birth certificate

- Brazilian CPF

- Signed power of attorney if purchasing from abroad

Foreign documents in English must be accompanied by a sworn translation and authenticated by a Brazilian Embassy or Consulate in your home country.

Best Places to Buy a House in Brazil

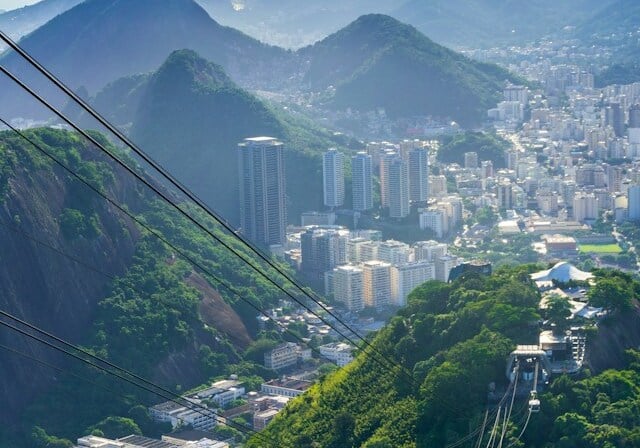

Rio de Janeiro: Real estate property in Rio offers some of the most scenic beauty the country has to offer, from breathtaking ocean views in Copacabana and Ipanema to views of the iconic Sugarloaf Mountain and Christ the Redeemer from Botafogo and Flamengo. The city is ideal for Americans retiring in Brazil, with foreign ownership common among expats in its most popular neighborhoods.

São Paulo: The country’s largest city is distinguished by its tall apartment buildings. Foreign investors can find a wide range of properties in neighborhoods like Vila Mariana, Jardins, and Moema, showcasing the city’s sophisticated urban and cosmopolitan lifestyle with numerous green spaces alongside expansive transport infrastructure and burgeoning real estate developments.

Florianopolis: While the city has a small population compared to larger Brazilian cities, it’s rapidly become a popular destination among Americans and other expats who live abroad. Florianopolis boasts natural beauty and many idyllic coastal areas to buy a home. You’ll find the ideal property in neighborhoods like Lagoa da Conceição, Santo Antônio de Lisboa, and Campeche, which are peaceful, safe, and have many residents from other countries.

Salvador: Salvador presents a more affordable option for those considering buying Brazilian property. Besides affordability, the city has an unmatched historic charm, with its well-preserved colonial architecture, cobblestone streets, and vibrant cultural identity that perfectly represent this diverse country. Additionally, the region offers the option of a reduced investment amount of BRL 700,000 to qualify for the Brazil Investor Visa.

What taxes and fees must I pay when I purchase property in Brazil?

While costs may differ based on the region in Brazil, here’s a basic breakdown of the primary Brazilian property taxes and fees incurred during property acquisition in Brazil:

Tax | Percentage |

Transfer tax (ITBI) | 3 to 5 |

Notary fees | 0.5 to 2 |

Registration fee | 0.75 |

Brazil property tax

Annual property tax in Brazil (Imposto Predial e Territorial Urbano – IPTU) is calculated based on the assessed market value of a property and imposed at different rates determined by the municipality and the property’s location. The rate is typically one percent for residential properties and 1.5 percent for commercial properties.

Average House Prices in Brazil

City | Price Per M² in the City Center | Price Per M² Outside the City Center | Average Price for a 100 M² Property |

Rio de Janeiro | $2,470 | $1,170 | $182,000 |

São Paulo | $2,665 | $1,865 | $266,000 |

Florianopolis | $2,115 | $1,600 | $185,000 |

Salvador | $975 | $425 | $70,000 |

Average house prices: Brazil vs the US

City | Price Per M² in the City Center | Price Per M² Outside the City Center | Average Price for a 100 M² Property |

Brazil | $1,760 | $1,220 | $149,000 |

United States | $8,360 | $5,680 | $702,000 |

These figures are approximate and compiled using data from Numbeo.

Financing a Brazil Property Purchase

The Brazilian mortgage industry is relatively underdeveloped and offers fewer options than most Western countries. Buyers typically expect to pay deposits of at least 20 percent of the property value.

Different banks offer different services, and some may offer mortgages specifically designed for commercial endeavors such as manufacturing units or rental property. There are no specific criteria to obtain a mortgage in Brazil; however, most banks, such as Bradesco, Caixa, and Santander, will require the following:

- CPF number

- Proof of residency

- Proof of a Brazilian bank account

- Proof of a fixed address

- Financial documentation proving you have enough money to repay the loan

- Property ownership deed

Brazil Permanent Residency by Buying Property

Buying real estate in Brazil serves as a qualifying investment for the Brazil Investor Visa (VIPER), designed to boost the country’s economy and stimulate growth through foreign investment.

Americans who purchase property in Brazil with a property value of at least BRL 1 million, or BRL 700,000 in the north/northeast region, can obtain permanent residency through the country’s VIPER visa program.

The application process requires submitting a bank statement from a Brazilian financial institution registered with the Brazilian Central Bank attesting to the transfer of the required funds and a title deed obtained from the local land registry office to Brazil’s Ministry of Labor to obtain the visa.

Alternative investment options for the permanent visa program include business investments that program job opportunities for residents.

After four years of residency — or three years with the 1 million property investment options — foreigners are eligible to obtain Brazilian citizenship and a Brazilian passport.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions about Buying Property in Brazil

Is it worth buying property in Brazil?

Brazilian real estate prices are considerably cheaper than in countries like the United States and the UK. The Brazil Investor Visa program provides the added benefit of granting permanent residence for a Brazil property investment.

Does buying property in Brazil give you citizenship?

Property acquisition in Brazil is not a path to citizenship and a Brazilian passport; however, Brazilian law grants eligibility for permanent residency to foreigners who buy property in Brazil with a purchase price of at least BRL 700,000. After four years of residency (three if the purchase price is BRL 1 million or more), foreign nationals may be eligible to apply for Brazilian citizenship.

How long can you stay in Brazil if you own a property?

Americans can stay in Brazil for 90 days on a visitor’s visa with the option to renew for 90 days. Foreigner nationals require a residence permit to stay in Brazil for over 90 days. Purchasing property worth at least BRL 700,000 or more may qualify you for a Brazil permanent residence permit.

Is it safe to buy a house in Brazil?

Buying a house in Brazil can be safe if approached with caution and thorough research. While the options and opportunities for buying property in Brazil are diverse, potential buyers should be aware of specific challenges and factors.

Legal intricacies require careful attention, such as ensuring clear property titles and navigating legal requirements. Engaging the legal services of a reputable lawyer and real estate agent can mitigate risks and provide valuable guidance throughout the process. Additionally, understanding the specific market dynamics and economic conditions in the chosen area is crucial for making an informed investment decision.