Your primary purpose for moving may be financial, but settling in a new country involves many changes you need to consider besides reducing your income tax.

For instance, the lifestyle of the people in the country might be difficult for you to adapt to. You could also be subject to additional taxes levied on citizens and residents, such as a tax on worldwide income.

This article will take you through the best countries to live in that have no income taxes, how to plan your taxes, and ways to reduce your tax liability at home.

Is no income tax a reality?

To answer the question of how tax-free countries work, it is that no-tax countries drive their economies from income generated through other means. Having alternative sources of income to bank upon makes this more than achievable.

For example, a Gulf country like Qatar or Kuwait in the Middle East is very rich in natural resources. Hence, their primary source of income is the oil and gas trade.

On the other hand, countries like the Bahamas, Antigua, and Barbuda attract thousands of tourists annually, generating the bulk of their income through the travel and tourism industry.

Moreover, countries with no income tax for foreigners can also be an opportunity to attract more foreign investments. No-tax and low-tax countries are functionally similar, but they use differing types of tax systems.

Countries with low taxes employ a tax levied strictly on local sources of income. On the other hand, countries without income taxes apply a straightforward system of zero income tax.

The Top 5 Tax-Free Countries in 2024

There are various income tax-free countries that you can choose to settle in. Most countries have a rule that once you spend 183 days of a year in their territory, you’ll be classified as a resident of that country and, therefore, liable to pay income taxes.

With a residence permit in a tax-free country, you’ll enjoy the benefits of what the country offers without paying income tax to live there. This section will discuss the best tax-free countries to move to and enjoy a tax-free life.

Antigua and Barbuda

In addition to this, the country also levies zero tax on wealth, capital gains, or inheritance.

If you’re looking for the best tax-free countries for business, in Antigua and Barbuda, registered International Business Companies (IBC) are not required to pay taxes for 50 years.

These taxes include corporate income tax on income from property, securities, and other financial assets. To replace Corporate Tax, these companies pay an annual fee that is dependent on the capital size that has been authorized.

But do note that Antigua and Barbuda do not possess tax treaties with multiple countries worldwide. Most of their treaties are with other Caribbean countries.

This points to the fact that you may have to continue paying taxes in your home country despite settling in Antigua and Barbuda.

Requirements

By investing just $100,000, you can obtain an Antigua and Barbuda passport for you and your family through their citizenship-by-investment program. To fulfill the criteria, the applicant should be:

- 18 years or older.

- Possess good character.

- Have no criminal record.

- Be in good health condition.

- Be financially capable of making the required investment in the country.

- Meet the residency requirement of a minimum of five days in the country within five years of obtaining citizenship.

- Available to take an oath of allegiance in Antigua and Barbuda or any embassy, high commission, or consulate of Antigua and Barbuda.

Antigua and Barbuda passport benefits

- The country imposes zero tax on worldwide income.

- The Antigua and Barbuda passport is comparatively more straightforward and cheaper to obtain than in other Caribbean countries.

- There is no education or language requirement.

- You can travel best tax-free countries to more than 140 countries with an Antigua and Barbuda passport.

- You can include up to four family members in your passport application.

- The country has a thriving real estate market. You can also invest in the country’s real estate to acquire citizenship.

UAE

Furthermore, oil companies and international banks must pay corporate taxes in the UAE.

The UAE has no citizenship-by-investment program, but in exchange for a 2 million AED ($545,000) investment in Emirate real estate in the Freehold Zones, you can obtain a ten-year residency visa to become a permanent resident in the UAE.

If you are a foreigner living in UAE with a long-term residency visa, then you are a tax resident. However, you must remain in the UAE for over 180 days to obtain a Tax Residence Certificate.

Apart from being a zero-income tax nation, the UAE also offers world-class education, a technologically advanced healthcare system, great business opportunities, and other facilities in which many foreign residents will find value.

Although cities like Dubai have adopted many Western customs and freedoms, it would be best if you also kept in mind that you need to follow specific rules and restrictions per the country’s Islamic code of conduct.

Check out our article: How to Get UAE Citizenship? Expert Guide.

Vanuatu

The country imposes no personal income taxes, inheritance tax, capital gains tax, or taxes on capital export for individuals living in Vanuatu.

By paying $300 per annum, companies don’t have to pay corporate or other taxes for the next 20 years.

But since Vanuatu doesn’t have tax treaties with many countries across the globe, individuals may have to pay corporate income tax in their home country. This also applies to personal income tax.

Vanuatu is also one of the few countries that provides a direct path for foreigners to gain citizenship through the best tax-free countries program.

You can acquire citizenship and a second passport within just one to three months by investing a minimum amount of $130,000 into the economy.

Check out our article: Vanuatu Taxes for Individuals and Companies – What You Need to Know.

- There is no personal earnings tax, wealth tax, inheritance, gifts, or tax on capital gains in the country.

- The best tax-free countries give you visa-free access to over 130 countries worldwide.

- You can include your family in your passport application for an additional $50,000.

- You can obtain the passport within one to three months in exchange for a very affordable investment of $130,000.

- With a Vanuatu passport, you can fast-track your application if you’re traveling to another Commonwealth nation.

St. Kitts and Nevis

What makes the country even more attractive is that there is zero income tax and no taxes on dividends, royalties, or interests for individuals with permanent residences.

Keep in mind that islands charge Corporate Tax at 33 percent, VAT at 10 – 15 percent, and property ownership at 0.2 – 0.3 percent.

By applying through the St. Kitts and Nevis citizenship by investment program, you can obtain the country’s passport in exchange for an investment of $250,000.

The requirements for citizenship include the following: The individual must be 18 years or above, have no criminal record, and have excellent personal health. In addition, foreign investors must be able to make a qualifying investment.

- The country has a tax-friendly infrastructure with zero tax on personal income or taxes on inheritance and gifts.

- With a passport, you can enjoy visa-free travel to more than 140 countries across the globe, including popular areas like the Schengen Area, the United Kingdom, and Singapore.

- You can include your spouse and two dependants in your citizenship applications for an additional $45,000.

- The country provides lifetime dual citizenship for applicants.

- You can accelerate your citizenship application process and obtain it within 60 days.

- There is no requirement for minimum residency, an interview, or the need to know a specific language to get permanent residence in the country.

Other Tax-free Countries in 2024

Apart from the abovementioned countries, several other countries have a no-income-tax policy. However, note that you can’t acquire citizenship in these countries by investing. Although, in some of these countries, you can obtain residency through investment. In these cases, it’s more expensive to acquire citizenship.

This section will take you through the list of other countries with no income taxes.

Country | Taxes on Companies/Individuals | Immigration by Investment | Lifestyle of the Country |

Bahrain | Corporate: Companies working in the oil and gas sector need to pay 46 percent income tax VAT: ten percent Property: Around 1.7-2 percent stamp duty and 10 percent municipality tax for rental to expatriates | You cannot obtain citizenship but can apply for permanent residency in the country. If you're an American retiree and invest $530,000 into real estate, you can obtain a residency visa through the Bahrain Golden Residency Visa program. The great thing about this visa is that it is renewable indefinitely as long as you continue to meet the requirements. | The country has a tropical climate with hot summers and cool winters. Expats constitute almost half of the population. 70 percent of people in the country are Muslim. |

The Bahamas | Corporate: To apply for a license for business, you have to pay around three percent of the turnover. VAT: Zero - twelve percent Property: One - ten percent of stamp duty and around 0.75 - two percent real property tax | You cannot acquire citizenship through investing. By investing $2.5 million, you can obtain residency. | The Bahamas is a famous Caribbean island with a warm tropical climate and a vast American expat community due to its close cheap flights and proximity to the US. The majority of the population of the country follows Christianity. |

Bermuda | Corporate: An annual company fee based on share capital levels VAT: Zero percent Property: A land tax based on the assessed annual rental value | You cannot apply for citizenship but can obtain residency by investing $2.5 million. | The isolated island nation sits between the Gulf Stream, which gives the country a warm and semitropical climate. Bermuda has beautiful beaches and picturesque landscapes. Expats constitute over 20 percent of the population, and most of the citizens in the country practice Christianity. |

Cayman Islands | Corporate: Not applicable VAT: Zero percent Property: 7.5 percent Stamp Duty | You cannot apply for citizenship, but you can obtain residency by investing $2.4 million. | The Cayman Islands have a warm tropical climate and are one of the best tax-free countries for business, consisting of various overseas organizations. The country also has an efficient health infrastructure. Most citizens follow Christianity, and more than half of the population in the country are expats. |

Monaco | Corporate: Companies earning more than 25 percent of their revenue outside Monaco must pay around 33 percent Corporate Tax. The standard Value Added Tax rate is around 20 percent Property – Not applicable | You cannot obtain citizenship, but by depositing €500,000 ($536,000) into a Monaco bank account, you can acquire residency. | Monaco is famous for its luxurious lifestyle and is frequented by Europe's elite. More than 70 percent of people in the country belong to the expat community. Most of the citizens in the country follow Christianity. |

Brunei | Corporate: 18.5 percent of income tax VAT: zero percent Property: Varies based on the municipality | Neither citizenship nor residency is possible in Brunei. | The country has a humid climate. The predominant religion is Islam. Around 40 percent of the population in the country consists of foreigners. |

Kuwait | Corporate: 15 percent income tax VAT: Zero percent, but the country plans to impose five percent this year. Property – None | Neither citizenship nor residency is possible in the country. | The country has a dry and hot climate but is one of the safest countries in the middle east. The majority of the population is Muslim. Expats constitute around 60 percent of the population. |

Qatar | Corporate: Ten percent Income tax: Zero income tax on worldwide income VAT: Zero percent, but the country will be imposing a five percent VAT this year Property: Fees for lease registration | You cannot apply for citizenship or residency in the country. | Qatar also has a hot climate. The majority of the population is Muslim. Around 88 percent of people in this country are foreign workers. |

Somalia | No Tax | You cannot apply for citizenship or residency in this country. | Recovered from failed state status but is a very economically unstable country and unsafe to live in More than 99 percent of the population is Muslim. |

Western Sahara | No Tax | You cannot apply for citizenship or residency in this country. | Owing to old territorial disputes, the country is tax-free. It is also not safe to live in this country. Most of the citizens practice Islam, followed by Christianity. |

Ways to Save Taxes: Easiest Countries to Relocate to

Various countries across the globe offer residency or business opportunities to help you save taxes. Most of these countries have very little to no residency requirements, so you don’t have to spend most of your time in that country.

Here is a list of a few countries to consider:

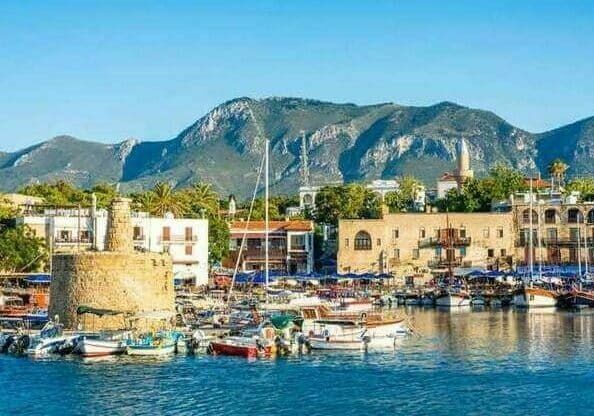

Cyprus

Malta gained independence from the United Kingdom in 1964 and became a republic in 1974.

The country is one of the world’s smallest and most densely populated countries. Its capital is Valletta, which is the smallest national capital in the European Union by area and population. Malta joined the European Union in 2004 and the Eurozone in 2008.

You are eligible to become a tax resident by spending 60 days a year in Cyprus and not spending more than 183 days in another country. Taxes in Cyprus are comparatively lower than in other countries.

Malta

Known for its rich and ancient history involving many civilizations, Cyprus was settled by Mycenaean Greeks in the 2nd millennium BC, becoming a site of Greek mythology, where Aphrodite is said to have been born.

The Republic of Cyprus was established in 1960 after gaining independence from British rule. It is a member of the European Union but is divided de facto into the Republic of Cyprus and the northern areas occupied by Turkish forces, recognized only as the Turkish Republic of Northern Cyprus.

This division occurred after a 1974 military coup by Greek Cypriots and a subsequent Turkish invasion.

An individual can obtain Maltese residency through Malta’s Permanent Residence Program (MPRP). With a Maltese long-term residency permit, you can pay taxes in Malta at a reduced rate compared to the standard tax rate imposed on citizens.

You can also access tax benefits on capital gains outside Maltese territory. A flat rate of just 15 percent tax is imposed on foreign income transferred to Malta with a minimum tax contribution of €15,000 ($16,000) per annum.

Check out this article for more information on the Malta Permanent Residence Program.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions about No Income Tax Countries

Which countries don't have taxes?

At present, there are 14 countries without income taxes.

These include Antigua and the neighboring Barbuda, Saint Kitts, the United Arab Emirates, Vanuatu, Brunei, Bahrain, the Bahamas, Bermuda, the Cayman Islands, Monaco, Kuwait, Qatar, Somalia, and Western Sahara.

There are also a few countries that have no property taxes.

Which Caribbean country has no earnings tax?

The Cayman Islands in the Caribbean has a tax-friendly infrastructure for its residents.

The country charges zero tax on your personal income, payroll, capital gains, or withholding tax. Check out our article on Caribbean taxes for more information.

Which is the best tax-free country?

Bermuda, the Cayman Islands, Saint Kitts and Nevis, Vanuatu, the UAE, and Antigua and Barbuda are some of the best tax-free countries in the world.

Do I have to relocate abroad to optimize taxes?

It’s not compulsory to move abroad to optimize taxes. You can also choose not to relocate but re-register your business abroad to reduce your tax liability.

Which European country has no income tax?

Monaco is a European country that doesn’t impose earnings tax on residents.

Why does UAE have no tax?

The UAE has no tax because, as an oil-rich country, it’s able to generate the bulk of its income from the oil industry.

The no-tax policy is also used to attract skilled expats, global talent, and international companies to boost the economy further.

Where is the safest European place to retire?

Portugal offers a relatively low cost of living compared to other Western European countries. Cities like Lisbon and Porto are popular among retirees, but smaller towns in the Algarve region are also attractive for their affordability and expat-friendly communities. Portugal ranks high in safety and healthcare quality.

Which European country has best retirement benefits?

According to a global pensions report from the Mercer CFA Institute, the Netherlands is recognized as having one of the best pension systems globally.

This report, which assessed over 50 indicators and compared 47 retirement income systems covering 64% of the world’s population, places the Netherlands at the top due to its comprehensive private and public sector pension benefits, system sustainability, and governance quality.

Following closely are Iceland and Denmark, indicating a strong performance by European countries in the domain of retirement benefits.

However, the report also points out areas for improvement in several other European nations and underscores the significant impacts of inflation, interest rates, and geopolitical uncertainties on global retirement income systems.