Over the last few years, many countries developed a new visa, specifically aimed at those with mobility and flexible schedules.

Joining the Malta and Portugal Golden Visa, Spain has approved a new Startup Act that includes a remote work visa for non-EU nationals.

This Digital Nomad visa allows individuals to live and work in Spain for up to five years, with the aim of attracting entrepreneurship and strengthening the country’s tech industry – and looking to move to Spain.

This digital nomad visa is different from a tourist visa, permitting you to legally work in Spain while complying with the Spanish Tax Agency. It can also lead to temporary residency or permanent residency.

About the Digital Nomad Visa Spain

In January 2023, Spain rolled out its Digital Nomad Visa as part of the new Startup Act—an array of measures created to boost entrepreneurship and attract foreign investments to the country. This visa option enables non-EU/EEA remote workers and freelancers to live and work in Spain for an initial 12-month period, extendable for up to five years.

Spain’s Digital Nomad is similar to a full employment visa. It grants temporary residency rights to foreigners for up to one year, provided they are employed and meet the Spain Digital Nomad Visa income requirements.

Sometimes referred to as the “Spain Remote Work Visa,” the digital nomad visa in Spain is specifically aimed at individuals who work remotely in the digital sphere. Until recently, digital nomads could only work for companies and clients outside Spanish territory.

However, that has since changed, and you can work for a company located in Spain as long as the percentage of the work doesn’t exceed 20 percent of the total amount of your professional activity.

Benefits of the Digital Nomad Visa

- Extended Stay: The Spain Digital Nomad Visa enables remote workers to reside and work in Spain for a prolonged period.

- Family Inclusion: This Spanish visa provides the opportunity to bring along family dependents.

- Schengen Zone Travel: Visa holders enjoy travel freedom within the Schengen Zone, comprising 27 European countries.

- Tax Benefits: Digital Nomad Visa holders, if employed or entrepreneurs, can opt for more favorable taxation under the special Non-Resident Income Tax Regime.

- Cultural Experience: Spain digital nomads can immerse themselves in the country’s rich cultural heritage, benefit from affordable living costs, and enjoy a high quality of life.

- Permanent Residence Pathway: After five years of continuous residence in Spain, visa holders may be eligible to apply for permanent residence.

- Citizenship Eligibility: With a decade of continuous residence, Digital Nomad Visa holders may qualify for Spanish citizenship.

Spain Digital Nomad Visa Requirements

As set out by the Spanish government, applicants must meet the following requirements:

- Applicant must have an undergraduate or postgraduate degree from a University, College or Business School of prestige

- or, have at least three years of work experience in their current field of activity

- Provide certification of working for at least three months (before the visa application) for a foreign Company

- Proof of financial means of at least 200% of the monthly Spanish national minimum wage – about €2,500.

Additional documents required for the digital nomad visa

Digital nomads who wish to apply for the visa through the Spain Digital Nomad Visa official website must submit relevant documentation, such as demonstrable foreign income, bank statements, and health insurance. The list of official documents remote workers must submit are:

- National visa application form

- A recent, passport-size, color photograph

- Valid passport

- Criminal record certificate

- Proof of residence in the consular district

- Evidence of paying the visa fee

- Original and a copy of the public or private health insurance covering Spain

In addition to providing the required documents, a digital nomad must prove a sustainable income of approximately €2,500 per month. Not providing enough details on any aspect of the nomad visa application can lead to the Spanish government asking you to submit additional documentation, prolonging the process.

- Digital nomads must prove that they earn at least 200 percent of the monthly Spanish national minimum wage. It’s beneficial if the money is deposited into a Spanish bank account.

- For the first accompanying family member such as a spouse, digital nomads must provide an additional 75 percent of the monthly Spanish national minimum wage. Any applicant after that requires an additional 25 percent in funding.

Who can get a Digital Nomad Visa for Spain?

The EU’s immigration policy already grants EU passport holders the right to residency and working from home in Spain without needing to formalize their stay if it is under six months. EU citizens also don’t need a Schengen Visa to visit Schengen countries.

The main eligibility criteria for the Spain Digital Nomad Visa for non-EU citizens:

- In possession of a valid passport

- Must be employed by a non-Spanish company or have clients outside Spain and must present their employment contract or remote worker status

- Must have a worldwide income with at most 20 percent earned from Spanish companies.

- Applicants must not have held residency status in Spain in the past five years preceding their application.

- Must provide proof of remote worker status (a document proving that they have been working remotely for at least one year).

- Applicants must hold a clean criminal record and have not been previously prohibited entry to Spain.

- Must have private health insurance coverage that is valid throughout Spain.

- Applicants must show proof of accommodation to house their stay in Spain.

Those who are full-time employees with a contractual agreement with a foreign company must demonstrate proof of working with their employing company for at least three months prior to their application date and provide written evidence that the company allows remote work.

Holders of the Spain Digital Nomad Visa will also have a more straightforward process when applying for residency on arrival in Spain, as the Spanish government requires them to register for a residence permit with local municipalities within 30 days of settling in the nation.

The Spanish government also stipulates that all applicants must have an undergraduate or postgraduate university degree, or have or have at least three years of work experience in their current field of activity.

This can be accompanied by a professional certificate declaring activities and studies.

How long does a Digital Nomad Visa for Spain last?

Holders of the Spanish Digital Nomad Visa who have acquired their renewable residency permit will be able to extend the validity of their temporary permits for an additional two years upon its renewal, making the Digital Nomad Visa valid for up to five years.

Foreign remote workers may obtain permanent residency after the fifth year. The primary condition is that they continue to meet the requirements of the Spanish government.

Digital nomads who stay in Spain will benefit from significant tax breaks under the Startup Act, namely paying non-resident income tax rates (IRNR) instead of resident income tax rates (IRPF) – this would mean they would only have to pay tax at a lowered rate of 15% on their personal income for a maximum period of four years instead of paying the average tax rate of 24%.

Additionally, should digital nomads choose to bring along their eligible family members, the special tax regime will be extended to the applicant’s spouse and children under 25 – or children of any age should they have disabilities.

How to Apply for the Spanish Digital Nomad Visa

The Spain Digital Nomad Visa went through several changes to iron out the details initially, but the government eventually set out a timeline and process for how to apply.

Step 1 – Book an appointment

Once you have gathered all the necessary documents, you need to schedule an appointment with the Spanish consulate in your area.

The requirements for translating documents into Spanish may vary depending on the location where you are submitting the application. While some consulates accept documents in the local language (e.g., English in the United States), others require translations into Spanish.

It is essential to have your translations done by a recognized translation service provider. You can obtain a list of approved providers from your local embassy or consulate. Remote workers must apply in person or appoint a representative to apply on their behalf

Step 2 – Attend the appointment

When attending your appointment at the Spanish embassy or consulate, make sure to bring all necessary documentation and be prepared to answer any initial questions that the interviewer may have after reviewing your documents.

You will need to surrender your passport at the embassy or consulate while they are assessing your application. During your appointment, copies of your documents will likely be taken or confirmed so that you can keep your original documents with you.

Once the documents you submit are verified by the application center, you’ll receive an email with details on how to book a follow-up appointment.

Step 3 – Wait for an outcome

If no further documentation is needed, you should receive an outcome of your digital nomad visa application in about ten days.

Those who acquire the Spanish Nomad Visa are permitted visa-free travel across the European Union’s Schengen Area, which consists of 26 EU member states—for as long as their permit is valid.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Spain Digital Nomad Visa Fees

The Spanish Digital Nomad Visa application fee depends on your relevant exchange rate and currency. However, you can expect to pay around $85 per application.

Taxes for Digital Nomads in Spain

In Spain, you are considered a tax resident if you spend more than 183 days in the country within a calendar year or if your main professional activities or economic interests are based in Spain. Tax residents are taxed on their worldwide income.

Spain offers a special tax regime for expatriates, commonly referred to as the “Beckham Law,” which allows qualifying individuals to opt to be taxed as non-residents for a period, thus paying a flat rate of 24% on their Spanish-sourced income up to €600,000 (as of the last update) and 47% on income above this threshold.

Apart from income tax, it’s important to consider social security obligations. If you’re working for a non-Spanish company but living in Spain, the situation can be complex, and you might need to make contributions in Spain, depending on bilateral agreements and your specific circumstances.

However, there are also circumstances where digital nomads who stay in Spain fall under the Startup Act, namely paying non-resident income tax rates (IRNR) instead of resident income tax rates (IRPF).

This would mean they would only have to pay tax at a lowered rate of 15 percent on their personal income for a maximum period of four years instead of paying the average tax rate of 24 percent.

Registering to pay taxes in Spain

Before paying taxes in Spain, you must register with the Spanish tax authorities and obtain a Tax Identification Number (Número de Identificación Fiscal – NIF). You can do that by registering at the nearest Tax Agency office.

Foreign non-residents can obtain a Non-Resident Identification Number (Número de Identificación de Extranjeros – NIE) by applying at the local Foreigners’ Office (Oficina de Extranjería).

Please note that to register your duty to pay Spanish tax for the first time, you must fill out Form 30 (“Modelo 30”). You will also need this form to update your information.

How To Get Spanish Citizenship Through the Digital Nomad Visa

The visa is valid for up to 12 months in and renewable for up to three years. After five years of continuously living in Spain, you may be eligible to apply for a permanent residence permit card. You may be eligible for citizenship after ten years of residence.

Best Cities for Digital Nomads in Spain

Spain offers a range of vibrant cities that cater to the needs and preferences of digital nomads. These Spanish cities not only provide conducive environments for remote work but also offer unique cultural experiences and a welcoming atmosphere for digital nomads seeking a fulfilling lifestyle.

Here are some of the best cities for remote work in Spain:

Barcelona

Barcelona

Barcelona stands out as a top choice for digital nomads, blending a bustling urban environment with stunning beaches. The city boasts a thriving tech scene, co-working spaces, and a rich cultural atmosphere. The unique architecture of Antoni Gaudí adds to the city’s charm, providing an inspiring backdrop for work and exploration.

Madrid

Madrid

As the capital and economic hub of Spain, Madrid is a dynamic city that seamlessly combines modernity with tradition. Digital nomads can benefit from the city’s extensive public transportation, diverse culinary scene, and a plethora of cultural attractions. The numerous co-working spaces and networking opportunities make Madrid an ideal destination for remote work.

Valencia

Valencia

Valencia, situated on the southeastern coast, offers a more relaxed pace of life for digital nomads. The city boasts a mild climate, beautiful parks, and stunning futuristic architecture. With affordable living costs and a growing startup ecosystem, Valencia provides an excellent balance for work and leisure.

Seville

Seville

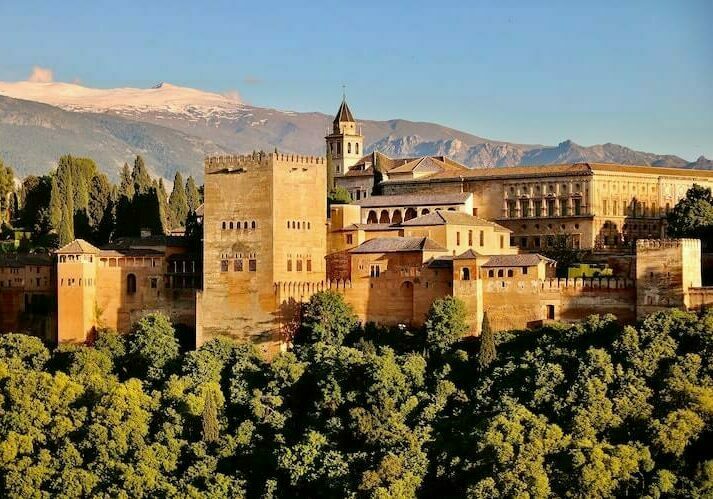

Seville, renowned for its historic charm and lively atmosphere, is an appealing choice for digital nomads seeking a unique experience. The city’s rich cultural heritage, iconic landmarks like the Alcazar and Giralda, and the winding streets of the Santa Cruz district provide a captivating backdrop for work breaks.

Palma de Mallorca

Palma de Mallorca

Palma de Mallorca in the Balearic Islands offers a refreshing alternative for those craving a blend of work and island life. With picturesque beaches, a Mediterranean climate, and a growing digital nomad community, Palma provides a relaxed setting for remote work, allowing professionals to enjoy the island’s natural beauty during their downtime.

How Can Global Citizen Solutions Help You?

Global Citizen Solutions is a boutique migration consultancy firm with years of experience delivering bespoke residence and citizenship by investment solutions for international families. With offices worldwide and an experienced, hands-on team, we have helped hundreds of clients worldwide acquire citizenship, residence visas, or homes while diversifying their portfolios with robust investments.

We guide you from start to finish, taking you beyond your citizenship or residency by investment application.

Frequently Asked Questions about the Spain Digital Nomad Visa

What is Spain's minimum wage?

Spain has one of the highest minimum wages in Europe and is currently €1,080.00 per month over 14 payments.

This is more than its neighbor Portugal, whose minimum wage is €886.66.

For the Digital Nomad Visa, remote workers would need to show that they earn at least €2,160 per month.

How much does the Spain Digital Nomad Visa fee cost?

The cost of the Spanish Digital Nomad Visa fee is dependent on your relevant exchange rate and currency, but you can expect to pay around $85 per application.

How can I get residency in Spain?

The Spain Golden Visa is a residency–by–program that grants qualifying individuals renewable residency rights in Spain in exchange for an investment in the nation’s economy, starting at a minimum of €500,000.

What is the minimum income for the digital nomad visa Spain?

To qualify, the digital nomad minimum salary is at least 200% of the monthly Spanish national minimum wage, which is about €2,500.

Can I work remotely in Spain for a company based in the US?

Yes, you can. You are not limited to the amount of work you do for companies outside of Spain.

However, if you work for a Spanish company, it can’t make up more than 20 percent of your income.

Do digital nomads pay taxes in Spain?

Yes. In Spain, you are considered a tax resident if you spend more than 183 days in the country within a calendar year or if your main professional activities or economic interests are based in Spain.

However, if you elect to be taxed as a non-residents, you’ll pay a flat rate of 24% on your Spanish-sourced income up to €600,000 (as of the last update) and 47% on income above this threshold.